Thanks to MassMutual for helping me share this information with you. All opinions are 100% my own.

April is Financial Literacy Month. To help you secure your financial future and protect those who matter most to you, Massachusetts Mutual Life Insurance Company is helping you take small steps so you can better understand your finances. MassMutual has the resources to help you achieve your goals with online tools and calculators, videos, and articles.

6 Tips for Increasing Your Financial Literacy

It just takes a few small steps to get started, such as identifying your short and long-term goals, creating a budget, or meeting with a financial professional. We are going to guide you through some of the tips so you can increase your financial literacy and help you succeed with your financial goals. I’m reading with intensity as we have one child who is just a year away (is it really just a year now!) from entering college.

Identify Your Financial Goals

Before you can even begin, you need to identify your goals. You can’t even begin to track and plan until you know what your goals are. Are you planning for retirement, planning for college (us!), or looking to provide for your family in the case you are unable to. Once you understand your goals, you can then being to take steps to achieve these goals.

Get Organized

Getting organized is an area that I struggle with and it can feel very overwhelming. Create a simple budget tracker to identify income, expenses, and any savings efforts you currently have in place. It may be a scary prospect to map out exactly what you are spending (um, where are all those cash withdrawals really going?) but it is important to identify risks and opportunities so you can begin your financial strategy.

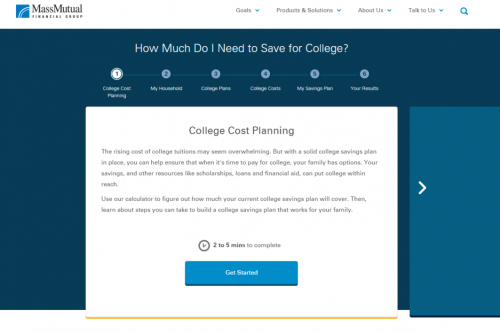

Use Tools to Help Your Project Your Savings Needs

To help you project your savings needs, you can use online calculators to see how much you need to save for your child’s college tuition or planning for your own retirement. These tools will ask you to enter basic information to help you determine how much you need to save and simple strategies to starting a savings plan.

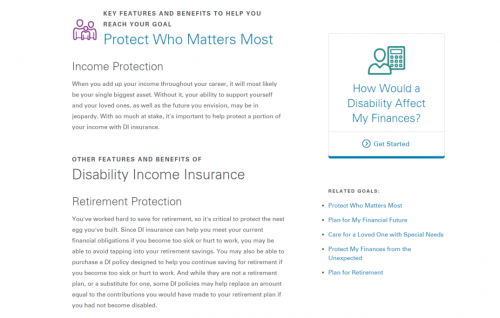

Consider Your Most Valuable Asset and How it Affects Your Future

What is your most valuable asset (besides your family!)? Your home? Your business? Your ability to work? Do you have measures in place to ensure your family is protected if you are too sick or injured to work? Of course, there is an online income gap calculator so you can see how disability might affect you and your family.

Teach Your Kids Early

Help your children build a strong future by getting your children involved in finances early. There are many simple and fun activities to get them excited about saving for the future. Encourage them to save at least a part of their money from birthdays, allowances, or from spare change they find around the house.

Find the Right People to Help You

There are expert financial professionals that will help you make important decision. Their knowledge and guidance can go a long way to help you secure your financial future by keeping your on track and informed. Connect with one in your area here.

Regardless of your financial goals, MassMutual has the resources to help you increase your financial knowledge. Visit MassMutual.com for tools and calculators, as well as videos and articles to help you increase your financial knowledge.

This is a sponsored post written by me on behalf of MassMutual. #MMFinancialTips #FinLit Rest assured, this Post was written by me and was not edited by the sponsor. Read more on my Disclosure Policy.